Being an investor, on the other hand, your choices usually are not limited to shares and bonds if you decide on to self-direct your retirement accounts. That’s why an SDIRA can renovate your portfolio.

Building the most of tax-advantaged accounts helps you to keep more of The cash that you just spend and get paid. Depending on no matter if you end up picking a traditional self-directed IRA or perhaps a self-directed Roth IRA, you have the opportunity for tax-totally free or tax-deferred progress, offered certain circumstances are met.

This involves comprehension IRS restrictions, managing investments, and staying away from prohibited transactions that may disqualify your IRA. An absence of knowledge could bring about pricey issues.

Selection of Investment Alternatives: Ensure the supplier lets the categories of alternative investments you’re interested in, which include real estate, precious metals, or non-public fairness.

Entrust can guide you in buying alternative investments with all your retirement funds, and administer the getting and providing of assets that are generally unavailable through banking institutions and brokerage firms.

And because some SDIRAs including self-directed conventional IRAs are subject to essential minimum distributions (RMDs), you’ll really need to plan ahead to make certain you may have ample liquidity to fulfill the rules set through the IRS.

Be in charge of the way you grow your retirement portfolio by using your specialised understanding and pursuits to speculate in assets that in good shape along with your values. Received expertise in property or personal fairness? Use it to guidance your retirement planning.

Real-estate is one of the most popular selections amid SDIRA holders. That’s because you are able to spend money on any sort of housing by using a self-directed IRA.

Complexity and Duty: Using an SDIRA, you might have a lot more Manage over your investments, but You furthermore may bear additional accountability.

In some cases, the charges connected to SDIRAs might be better plus much more complex than with a daily IRA. This is because with the elevated complexity connected to administering the account.

The key SDIRA policies with the IRS that traders need to have to be familiar with are investment limits, disqualified individuals, and prohibited transactions. Account holders need to abide by SDIRA rules and restrictions as a way to protect the tax-advantaged standing of their account.

Believe your Good friend could be commencing the next Facebook or Uber? Using an SDIRA, you may invest in leads to that you believe in; and possibly enjoy greater returns.

Not like stocks and bonds, alternative assets are frequently more difficult to sell or can have rigid contracts and schedules.

Research: It's termed "self-directed" for a cause. With an SDIRA, you will be fully responsible for comprehensively exploring and vetting investments.

An SDIRA custodian is different because they have the suitable staff members, abilities, and capability to maintain custody of the alternative investments. The first step in opening a self-directed IRA is to find a company that is certainly specialised in administering accounts for alternative investments.

Criminals occasionally prey on SDIRA holders; encouraging them to open up accounts for the goal of creating fraudulent investments. They typically fool traders by telling them that if the investment is approved by a self-directed IRA custodian, it has to be authentic, which isn’t accurate. Once again, You should definitely do thorough research on all investments you select.

When you finally’ve discovered an SDIRA supplier and opened your account, you could be pondering how to really start out investing. Comprehension both The find more principles that govern SDIRAs, along with ways to fund your account, can help to put the inspiration for the future of prosperous investing.

Right before opening an SDIRA, it’s vital that you weigh the prospective pros and cons determined by your particular monetary targets and risk tolerance.

Increased Charges: SDIRAs often feature higher administrative expenditures as compared to other IRAs, as certain areas of the administrative approach can not be automatic.

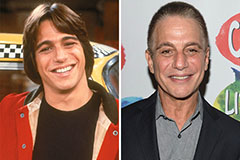

Tony Danza Then & Now!

Tony Danza Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!